All Categories

Featured

Table of Contents

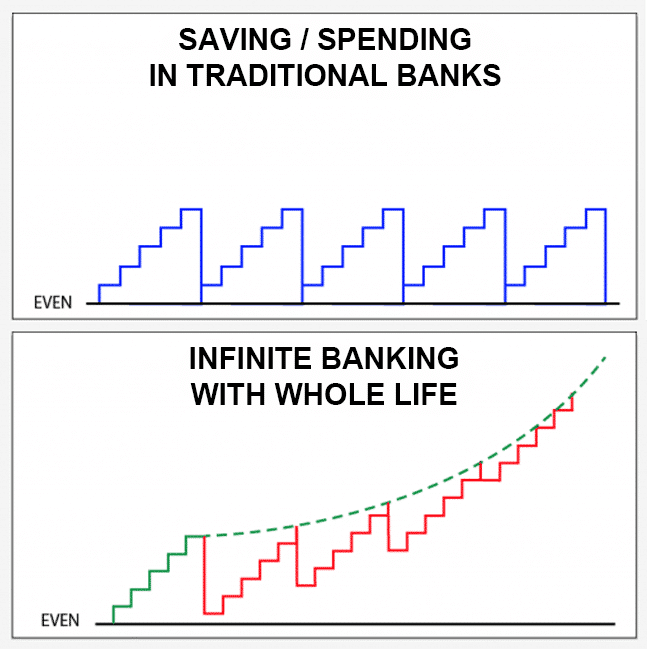

Okay, to be reasonable you're really "banking with an insurance policy business" rather than "banking on yourself", however that principle is not as easy to sell. Why the term "infinite" banking? The idea is to have your cash functioning in numerous places at the same time, instead of in a solitary place. It's a little bit like the idea of acquiring a residence with cash, after that borrowing against the home and placing the money to operate in another financial investment.

Some individuals like to speak about the "rate of money", which basically implies the exact same thing. In truth, you are simply making the most of leverage, which functions, however, naturally, works both means. Truthfully, every one of these terms are scams, as you will see listed below. That does not mean there is absolutely nothing worthwhile to this concept once you get past the advertising.

The entire life insurance policy market is tormented by overly expensive insurance coverage, huge payments, questionable sales techniques, reduced rates of return, and inadequately informed clients and salespeople. But if you wish to "Rely on Yourself", you're going to need to wade into this market and in fact acquire entire life insurance policy. There is no substitute.

The assurances fundamental in this item are vital to its function. You can borrow versus most kinds of money value life insurance, but you shouldn't "bank" with them. As you get a whole life insurance policy plan to "financial institution" with, bear in mind that this is an entirely separate area of your economic strategy from the life insurance policy section.

Acquire a huge fat term life insurance coverage plan to do that. As you will certainly see below, your "Infinite Financial" plan really is not going to accurately offer this crucial monetary feature. One more issue with the reality that IB/BOY/LEAP depends, at its core, on an entire life policy is that it can make getting a policy troublesome for a number of those interested in doing so.

Infinite Banking Concept Dave Ramsey

Harmful leisure activities such as SCUBA diving, rock climbing, sky diving, or flying likewise do not mix well with life insurance items. That may work out great, because the factor of the plan is not the death advantage, but keep in mind that acquiring a policy on small children is a lot more expensive than it should be given that they are generally underwritten at a "typical" rate instead than a favored one.

The majority of policies are structured to do one of 2 points. The compensation on a whole life insurance policy is 50-110% of the very first year's premium. Sometimes plans are structured to maximize the death advantage for the costs paid.

With an IB/BOY/LEAP plan, your objective is not to optimize the fatality benefit per dollar in costs paid. Your objective is to take full advantage of the cash money worth per buck in premium paid. The rate of return on the plan is really important. One of the most effective means to make best use of that factor is to get as much cash money as possible into the policy.

The most effective way to enhance the rate of return of a plan is to have a fairly little "base policy", and then placed more cash right into it with "paid-up additions". As opposed to asking "How little can I place in to get a specific fatality benefit?" the concern becomes "Just how much can I legally took into the policy?" With even more money in the policy, there is even more money worth left after the expenses of the death benefit are paid.

An extra advantage of a paid-up enhancement over a routine costs is that the commission price is lower (like 3-4% instead of 50-110%) on paid-up additions than the base policy. The much less you pay in payment, the higher your rate of return. The rate of return on your cash worth is still going to be negative for some time, like all cash worth insurance coverage.

The majority of insurance coverage companies just provide "straight acknowledgment" loans. With a direct recognition finance, if you borrow out $50K, the returns price used to the cash worth each year just uses to the $150K left in the plan.

Is Bank On Yourself Legitimate

With a non-direct acknowledgment finance, the firm still pays the very same reward, whether you have "borrowed the cash out" (technically against) the policy or otherwise. Crazy, right? Why would certainly they do that? That recognizes? However they do. Often this feature is paired with some less helpful aspect of the plan, such as a lower returns rate than you may receive from a plan with straight recognition financings (infinite banking reddit).

The companies do not have a source of magic totally free money, so what they provide in one place in the policy need to be drawn from an additional place. If it is taken from a feature you care much less around and put right into a feature you care more about, that is a good thing for you.

There is one even more important feature, normally called "clean car loans". While it is fantastic to still have dividends paid on cash you have gotten of the plan, you still have to pay interest on that car loan. If the reward rate is 4% and the funding is charging 8%, you're not specifically coming out ahead.

With a laundry finance, your funding rate of interest rate is the same as the dividend rate on the policy. So while you are paying 5% passion on the loan, that interest is entirely balanced out by the 5% returns on the finance. So in that regard, it acts just like you withdrew the cash from a bank account.

5%-5% = 0%-0%. Same very same. Therefore, you are now "financial on yourself." Without all 3 of these variables, this policy just is not going to function really well for IB/BOY/LEAP. The most significant concern with IB/BOY/LEAP is the individuals pushing it. Almost all of them stand to make money from you acquiring right into this idea.

There are numerous insurance coverage representatives chatting about IB/BOY/LEAP as a feature of whole life who are not in fact marketing policies with the necessary attributes to do it! The trouble is that those who understand the principle best have a huge dispute of passion and usually inflate the advantages of the concept (and the underlying policy).

What Is Infinite Banking Concept

You ought to compare borrowing versus your policy to withdrawing money from your financial savings account. Return to the start. When you have absolutely nothing. No deposit. No money in investments. No cash in cash money worth life insurance coverage. You are confronted with a selection. You can put the cash in the financial institution, you can spend it, or you can buy an IB/BOY/LEAP plan.

You pay tax obligations on the interest each year. You can save some more money and put it back in the financial account to begin to make interest once more.

It grows for many years with capital gains, dividends, rents, etc. Some of that earnings is taxed as you accompany. When it comes time to get the watercraft, you offer the investment and pay tax obligations on your lengthy term capital gains. You can conserve some more money and acquire some more financial investments.

The cash value not utilized to pay for insurance coverage and commissions grows over the years at the returns rate without tax obligation drag. It starts with unfavorable returns, however ideally by year 5 or two has recovered cost and is growing at the reward price. When you most likely to acquire the boat, you obtain versus the plan tax-free.

Infinite Banking Concept Book

As you pay it back, the cash you paid back begins expanding once again at the returns price. Those all work rather in a similar way and you can contrast the after-tax rates of return. The 4th alternative, however, functions very in a different way. You do not save any kind of cash nor buy any kind of investment for many years.

They run your credit history and provide you a financing. You pay rate of interest on the obtained cash to the financial institution up until the finance is paid off.

Latest Posts

Infinite Banking Excel Spreadsheet

Infinite Banking Uk

Ibc Life Insurance